What’s it like to try to live on earned income in the US, in 2024 – details and data source links under the video.

What’s it like to try to live on earned income in the US, in 2024:

INCOME + COST OF LIVING

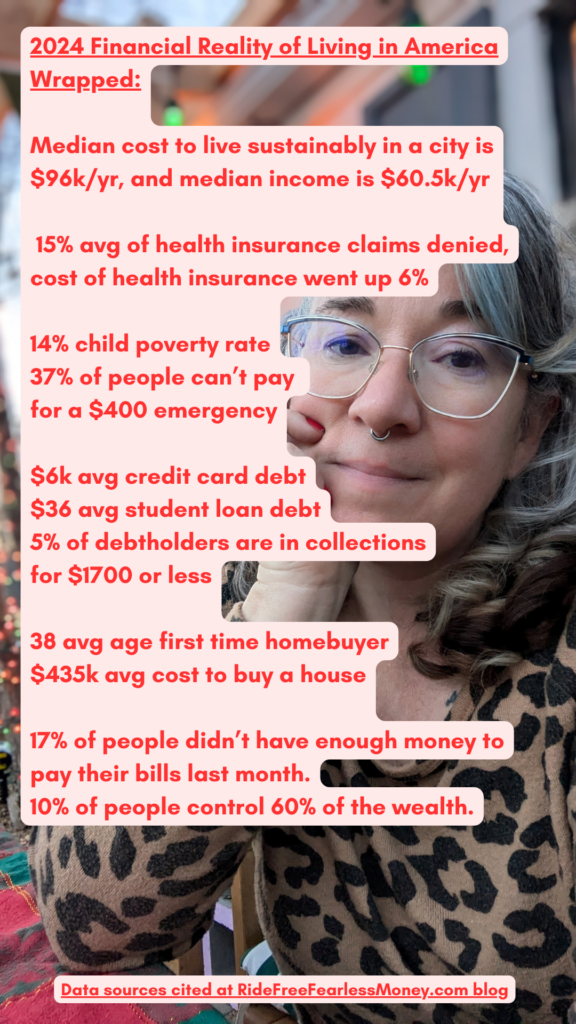

$60,580/yr is the median income of full-time workers in the US [data source – BLS, Q3 2024], but the median cost of living in the 99 largest US cities is $96,500 – if you follow the rule of thumb that housing and bills should only take 50% of your income, leaving you 20% to save and 30% for discretionary [data source – SmartAsset, Q1 2024].

HOME PURCHASES

“Median first-time buyer this year was 38-years-old …The average age of homebuyers in 2024 was 56, a record high, according to a report from the National Association of Realtors (NAR), highlighting the impact of soaring housing prices and elevated mortgage rates.” [data source– NAR, reporting source]

The median sale price in October 2024 was roughly $434,700 [reporting source], according to Redfin. The average mortgage rate is 6.4% in October 2024.

CLASS, POVERTY AND CHILDREN

43% of people in the US identify as lower-class or poor [source].

The child poverty* rate is 13.7% [data source – Columbia University, 2023] — this means one in seven kids in the US is in a family that lives on under $20,440 for a family of 2 or under $25,820 for a family of 3 [source DHS 2024 FPL], which has long-term negative effects on kids [source]. Also the fact that we have something called the child poverty rate is shameful given how much money we have as a nation.

DEBT

Total household debt rose to an average of $17.80 trillion in the second quarter of 2024 according to the Federal Reserve Bank of New York

Average credit card debt is $6,275 and average student loan debt is $35,700. [reporting source, Q2 2024]

Credit card balances hit $1.17 trillion in Q3 …and consumers with a third-party collection account on their credit report remained relatively stable, at 4.6 percent, but the average balance of those collections rose to an all-time high of $1,705. [data source – NY Fed, Q3 2024],

CASH FLOW LIMITATIONS

US Average savings account balance is $12,500 – but the average savings is $2,100 for those in the lowest 20% of income [reporting, Q2 2024, and data source] – which is under one month of not working away from being out of money.

17% of Americans didn’t have the money to pay all their bills last month, and 7 of 10 people earning under $100k said cost of living had made their financial situation worse, 3 in 10 people earning under $50k did not have enough to eat in the last month, and 37% of people would struggle with a $400 emergency expense: 13% of people could not cover it in any way, and another 24% could not cover it in cash [source Federal Reserve, May 2024].

Meanwhile, 10% of people own 60% of the wealth [source, 2022 data] – and the top 1% own 30% [source, 2023 data].

HEALTH INSURANCE

Meanwhile, health insurance costs have gone up 6% this year [after 7% increase last year, source, Q3 2024] and the rate of claims that need to be approved and the denial of these approvals has increased [source] to around 15% on average [source], and happen more frequently for higher-cost medical needs [source] – however “One area of concern is the Medicare Advantage (MA) program, where over a quarter of claims are subject to prior authorization, and nearly 20 percent of discharges to post-acute care settings are initially denied.” Notably, MA programs are administered by private companies, specifically: UnitedHealth, Humana, and Kaiser.

WAGES

Wage increases averaged 4.6% as of Q3 2024 [source], and inflation overall was at 2.6% as of October 2024, but housing is up 4.9% [source].

…honestly why hasn’t the class war started earlier? are we still thinking we’re all temporarily embarassed millionaries [Steinbeck] or…