Let’s be real: there’s so much about our lives and money changing so quickly, and many long-term changes we aren’t yet able to wrap our heads around or truly understand.

This post is a collection of lots of resources: first for individuals & households, then for small business owners. Keep scrolling on down for my 0.02 economic analysis

Before you dive in and get overwhelmed — first, I want you to pick one short period of time and think about it: the next week or the next month. What do you want to get your head around in that time? What will you learn or try in this short period?

You *can* get ahead of overwhelm, one step at a time <3

Resources for Individuals, Partners & Families

WTF IS MY MONEY DOING RIGHT NOW?!?

You really need to know how much money you *must* spend, and what you have been spending, now more than ever.

I suggest you start with a simple four-number system to make a plan for your finances. Those numbers are:

income – fixed expenses – goals/savings/giving = discretionary spending left to use.

If you can get close enough with each of your four numbers, you can make a workable, informed plan! And, when they change – like oh say in a pandemic-fueled recession, you will know how to reassess your spending plan.

Here’s a free, short workbook to help you come up with a spending snapshot & plan! https://www.ridefreefearlessmoney.com/simplify-your-budget-four-numbers-download/

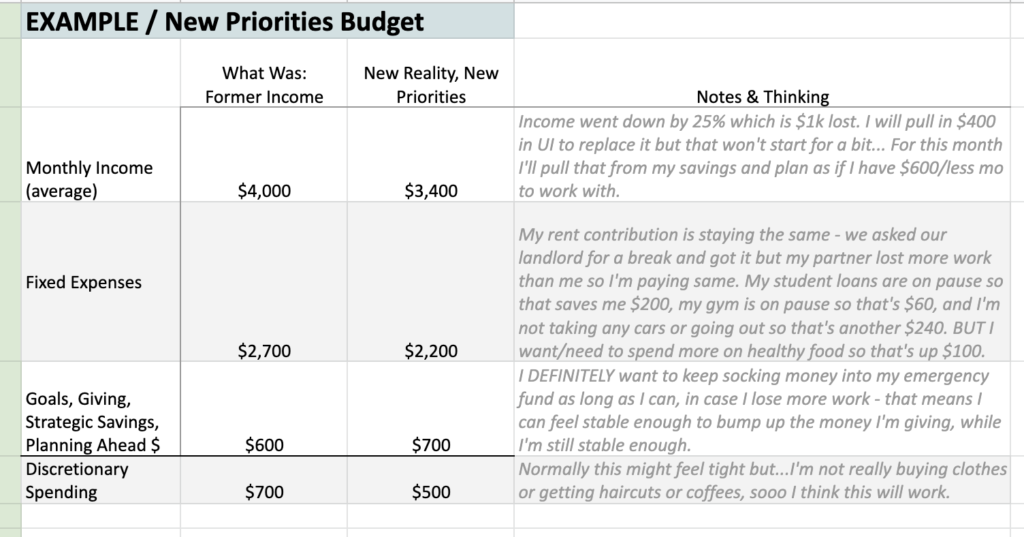

Pandemic Budget: New Realities, New Priorities

Given that for a lot of people & households, income is in flux, you might want to consider making a “New Priorities” budget to use. Once you have some base level income/spending understanding in place, it can help you make this New Reality/New Priorities budget, if needed, *based on actual data about what you’ve been spending, what you can change, and what you will do moving forward.*

Here’s an example:

If you spend without noticing, you might want to see if you’ve spiraled into some unhelpful spending patterns; Here’s a list of ways to save and spend less money .

THIS IS SCARY, WHAT HAPPENS IF I DIE?

Yes, this is scary and yes you have to think about what happens if you get really sick or pass away.

The literal only thing that scares me more than dying of COVID-19 in the freaking Javits Center, is my greedy evangelical parent being called by the hospital instead of my partner, or coming for my hard saved money after the worst has happened. LUCKILY THIS AIN’T HOW IT’S GOING DOWN.

I have two documents to prevent that and you can, too:

1) Advance directives. Eg a “Living Will” and “Medical Proxy” outlining who can make decisions on my behalf if I can’t. Otherwise – it defaults to biological family or legally wedded spouses only FYI. You can make an advance directive for free. Here’s a list organized by US State.

2) A Will stating who gets what from my lil retirement money etc. IF YOU OWN ANYTHING OR HAVE ANY $$ MAKE A WILL, PLEASE. You really don’t want the state figuring it out for you on their timeline according to their rules.

Even before you make a Will, the first fastest thing you can do is to make sure any retirement investment accounts or insurance policies you have, have “beneficiaries” assigned – that should circumvent probate (court review) and move money to people efficiently after you pass.

Next, especially if you have other money or any property, get a “real Will” done by a lawyer. I honestly think legalzoom et al is not a great option (it’s both expensive yet offers only minimal customization) and if you want to designate friends or organizations to get some of your estate you’re going to be an edge case. The NY local Moira Meltzer-Cohen, Attorney at Law is a good option and can do work for your remotely (and she defended Chelsea Manning so we extra love Mo), or ask around and find out who did your friends’ Wills.

Also, Notaries can now work remotely – so if you put together a Will, either the Lawyer you work with will notarize it or you can get it Virtual Notarized 🙂

3) Make sure your main password is written down somewhere (I have mine on a sticky note on my Living Will), in the event that someone needs to access your accounts if you can’t.

4) Have a check-in with your people to make sure they have these documents and prep items and that you know where they are <3

NO SERIOUSLY I AM WAY F-ED

Have debts you suddenly can’t afford to pay? Call them to ask for Covid-19 forbearance. Most mortgage and credit card companies, and the federal student loan system, are offering programs to pause payments, for example .

- *Federal* Student loan payments are to be suspended 4/11/20 – 9/30/20. Interest will keep accruing (the irony) so if you can pay even a little, that can help keep you from coming back to a bigger monthly payment.

I need urgent food / resource support:

- Here’s a US map of orgs offering aid, and here’s a NYC one

- If you’re in NYC and food insecure here’s a list of soup kitchens and places giving out food <3

What’s up with this stimulus package for individuals? I need Unemployment Insurance, and I’m curious about that stimulus check:

The CARES Act expanded unemployment insurance with the PUA. It extends WHO can get UI (almost anyone who’s work was impacted) AND it increases the amount of money bring paid out by $600/week.

Here’s the NYS explainer of eligibility. States are rolling it out themselves (so your state’s UI website might not be updated yet).

I HAVE TIME OR MONEY, LET ME HELP

MUTUAL AID, RADICAL CARE & COMMUNITY CARE

Got $50-$100 to donate this minute? Go here, and get connected to 10 people you can give $5-10 to now: https://www.leveler.info/

US-wide mutual aid hub: https://www.mutualaidhub.org/

NYC Mutual aid projects: http://mutualaid.nyc/get-involved/groups/

Philly based general and mutual aid resource list

Donate to one of the many mutual aid projects at the links above, or perhaps this one in BK supporting hourly wage workers or this COVID-19 Mutual Aid Fund for LGBTQI+ BIPOC Folks or this one for disabled folk in US.

Do your best to stay home, wash your hands, and call your friends, family, and colleagues — and while you are there, how about some reading…

COMMUNITY CARE & COLLECTIVE CARE

- Tara Mohr’s on fear and the pandemic

- Collective Care is our Best Weapon – gdoc w LOTS of mutual aid networks _ resources

- Check out my video on the economics of interconnectedness

- Cindy Lee Leaves’ compiled LOTS

- Community Care resources, gulf south based

Resources for Small Business Owners, Freelancers, Artists

Stop: make sure your critical passwords are written down somewhere known, or already shared with the trusted members of your team who need them, in case you get sick, can’t work on your business, and need to ask for help.

CANADA SMALL BUSINESS

- Department of Finance Canada – loans for businesses through your bank including a Small and Medium-sized Business Loan and Guarantee program; deferral of tax remittance

Business Development Canada – much more readable version 🙂

US GOVERNMENT HELP FOR SMALL BUSINESSES & SELF-EMPLOYED PEOPLE

What the hell did Congress pass in late March and can my business get some money for relief from it? The CARES Act, and maybe you can. There are two SBA loan programs.

- Federal Website with the basics: there are two loans available, both of which allow some of the money disbursed to convert to a grant if used for certain things (paying people, servicing debt, operations)

- Explainer on both UI and SBA grants

The EIDL “Disaster Loan” – a federal program administered by States:

- Here’s a list of all States’ loans: https://disasterloan.sba.gov/ela/Declarations/Index

- Here’s the NYS SBA loan explainer document process http://www.nysbdc.org/EIDL.html

- You might need a physical location

The CARES Act:

- Meant to cover 2.5 months of payroll, and will be forgiven *if you use it for payroll* eg if you keep people employed.

- Means you need to have already had people on a payroll to qualify for forgiveness

Here’s a summary of CARES Act SBA loan rules from the good folks at the Brewers Association, https://www.brewersassociation.org/brewing-industry-updates/covid-19-sba-loan-qa/, who share “If your business has under 500 employees, was operational on February 15, 2020, had employees for whom it paid salaries and payroll taxes, and has been impacted by COVID-19, then you are likely eligible for a loan. You must make a good faith certification that you have been impacted by COVID-19 and will use the funds to retain workers and maintain payroll and other debt obligations.”

Are you self employed and trying to get Unemployment Insurance? You quite likely can!

Your state should have explainer resources, but here’s the Federal guidelines: https://www.benefits.gov/benefit/597 and the AEMI’s chart explaining UI Govt $upport Flow Chart (same as the image above)

NYC-Specific

Run a small business with 1-5 employees in NYC? They have a retention grant program to help you cover up to 40% of your payroll — apply here.

This doc from Loom has SO MANY GOOD resources – including:

- US federal, state-by-state, and city breakdown of grant/loan/assistance programs

- Private sector assistance (lots of grants) from banks, utilities, major corps…

- Creative / Artist? Check this out for lots of loans and grants…

- Assistance for food/beverage industry

Yet more small business relief programs, here from Forbes

Are you LGBTQIA+ and running a business? The NGLCC has a resource list for you here!

MONEY FOR CREATIVES, ARTISTS, COMMUNITY WORKERS

- List o’ grants and resources for artists & creatives

- Resources for freelance artists

- Freelancers and Community Creatives resources

WHAT THE HELL, IS THIS THE APOCALYPSE?

Look: I don’t know anything about public health or epidemiology [here’s data that does] but I do know that markets are touchy and don’t, ahem, make money ALL the time. For example:

- Our fact friends at Wikipedia have listed out the 45 market crashes and corrections over the last 200 years (hint: these are regular occurrences)

- Check out my video on systematic risk and COVID-19 (tldr; market drops are normal but suck a lot)

What’s important is the difference between markets and economies: “the economy” is a shorthand for the exchanging we do with each other and our businesses do with other businesses. This exchange has a long tail: I buy coffee from the local shop, who gets beans from a fair trade supplier, who pays growers, all of whom pay their employees and bills – and buy their coffee from their local shop along the way.

Much like the internet gave us new ways to exchange and created tons of companies, wealth and opportunity, a break in how we *exchange* can be really damaging to the stops along the way of these flows. It *IS* possible to have more resilient exchange chains, but that requires less precarity at each stop. Precarity in this case would mean not being able to support the outflow to your needs and obligations if the inflow stops. Which is pretty common: most people and businesses need to exchange because they need to bring in, in order to meet needs and obligations.

Let’s be clear:

Exchanging with others, having supply chains = NOT inherently precarious. 100% since the dawn of human experience we’ve done this.

It’s only when a slowdown to exchange or a break in your chain **means** being unable to meet needs and obligations that it’s precarious. In the current scenarios, that could look like closing your business, laying off employees, potentially falling into a debt or losing home or food stability,etc.

The specific thing that is precarious is the part where not having the inflow to meeting obligations/needs MEANS YOU’RE OUTA LUCK.

That, friends, is what to solve for.

It is, unfortunately, also a major incentive system of the current economic system: make money, or else.

There has been creation and development of other incentives and models, for example:

- exchange with others because each of us deeply needs to contribute our gifts and be interconnected and witnessed in our ability to contribute

- create communities of exchange because no one can or should be good at everything and it’s wonderful to value things others are good at that we’re not

These are seedling ways to think about what to keep as we witness what breaks in our current economy.

There are also plenty of ways to soften the harshness of the “or else.” A few public ones include:

- Social safety nets, like unemployment insurance, social security, disability insurance etc

- Public healthcare that’s not tied to employment

In the US, we are deep about individual solutions, so a lot of the expectation is that you’ll fix your “or else” personally – with family wealth,

Community networks also pick up where individual or public coverage fall short: or it gets farmed out to church or neighborhood networks.

But what we’re seeing is, in part, the result of decades of defunding public programs. AND we’re seeing that the money for these programs can be found in a matter of DAYS if the depth of the flow interruptions is great enough. Hmmmmm.

In the meantime, you’re resilient and your connections to others are important: please, go strengthen those.

As always, I am around with sliding scale 1:1 strategy sessions about your money, and my online course on saving and creating a budget is here!