Divesting from Fossil Fuels: the Movement’s Strategy

In a recent article in Nature, the author brings in scientific models which indicate that by 2100, “the world will probably heat up by substantially more than 2 °C above pre-industrial temperatures, with grave consequences for ecosystems and societies.” If that’s too far in the future to understand, how about this: the global demand for fossil fuels, and therefore emissions from them, are predicted to keep rising until 2040, and petroleum is forecasted to begin to run out as a meaningful source of energy by 2050.

I can remember 30 years ago, I was 8. We had WINTER in October here in the US Northeast then. The fact that 20 years into the future we’ll still be pumping heat-trapping carbon into the atmosphere and 30 years from now peak oil will hit gives me great pause to consider the world I’ll be in at 68. Thus, I’m very glad for, and glad to support, movements to transform the economics of carbon-emissions.

Divesting can be broadly defined as moving money away from ecologically and socially harmful industries, and currently the largest focus is on carbon impact. As a broad and growing global movement, divesting is part of international policy and economics conversations. For example, at the Nov 2017 UN Climate Talks in Germany, more than 170 parties, including the European Union, that have ratified the Paris agreement and reaffirmed commitment, regardless of the US’s rash decision to withdraw.

If this matters to you, you may want to know where strategists who work on this issue every day are steering the growing global movement to move money out of fossil fuel-based investments, and how the argument for divestment is being supported. In this article we’ll look at these, as well as resources for everyday individuals to examine our investment connections to fossil fuels and touch on alternative investing options.

The financial strategies used by fossil fuel divestment campaigns today

To begin understanding how a call to divest is gaining traction, you need to understand that the argument is winning based on financial analysis, not an ethical call to action.

The basic arc of the argument focuses on:

- Acknowledging that fossil fuels (FF) are unsustainable, that is: we know they will run out – and seeing that as a signal of financial volatility. (that’s a very bad thing)

- Accrediting the research and lawsuits against companies directly responsible for carbon emissions as an indicator of liability – and accounting for the financial impact of settlements against profitability

- Analyzing both fossil fuel equity holdings and capital reserves as a liability, due to this volatility and responsibility – and indexing that risk to a company that holds these

So, the argument goes, the fiscally responsible thing to do given the evidence now is to replace funds or individual equities (stocks) that are directly carbon-based or undergirded by fossil fuels in any way with non-FF-connected ones.

RESERVES & EXPOSURE: A FANCY WAY TO THINK ABOUT SAVINGS

Let’s start with explaining holdings and fossil fuel reserves and what that means.

For individuals, we have savings. For companies, they have reserves. It’s the same thing (money you don’t spend now or resources you hold back so you have it to cover your costs if your income drops later), it’s just called something different.

When your or my reserves were mostly in cash, they’d be losing value relative to inflation over time. That might mean a few grand to us – but if your reserves are on the order of tens of millions of dollars or more, losing 2% a year to inflation is a big problem. So, reserves get put into other investments so as to make money and/or retain value. And because the market is, overall, risky, we don’t put our money all in one place and neither do corporations.

If your or my reserves were in mostly, say Tesla stock, we’d be counting stacks of theoretical benjamins right now. If your or my reserves were only in funds managed by say Bernie Maddoff, we’d be out of luck (and money). So, much like it’s a good idea for any of us to put our reserves in various places so they keep up with inflation, companies do this too. They manage risk by putting their reserves all over the place: equities (stocks), bonds, gold, and -yes- crude oil.

You need to think of companies as little fifedoms, small kingdoms, who have enough money to buy and hoard barrels of oil, because that is what’s happening. It’s both a hedge against price spikes and a hedge against risk. It’s like buying diamonds, but more useful — until such time as it can no longer be used. And any particular thing you’re holding onto as an asset is also an exposure. You’re exposed to the value of gold dropping. You’re exposed to stocks losing value. You’re exposed to oil companies dropping in value or oil being part of a lawsuit.

Valuation and FF Reserves

And that’s where the fossil fuel divestment strategists come in. Corporations’ value are based on an interplay of factors:

- the money they are expected to make from actual sales

- the money they are expected to make from predicted or forecasted products

- the reserves they have on hand to stay solvent

- the liabilities they owe in debt and leveraged assets

There’s several ways to run your predictive analysis on the short- and long-term valuation of any portfolio (the things you own), and if you take into account models of risk in climate change then the long-term effects of oil’s volatility start to look less like a sure thing and more like a liability.

At least annually corporations must report to their shareholders (that’s you or I if we owned stock in them) as to their financial health, and included in this report is a SEC filing (here’s a link to BlackRocks). Funds release a shareholder statement (here’s an example of one of Vanguard’s). In these, we can find a list of the assets any company is claiming as part of their portfolio, and companies also must disclose reserves and their exposure – though not in full detail.

It’s the possibility of fossil fuel liability that is causing research economists as well as scientists to urge companies to fully disclose possible climate impact – and investors to observe which companies might be vulnerable to climate change ramifications. (For a truly in depth analysis on the topic, read this).

Full disclosure aside, analysts are able to dig into these statements, create model portfolio and reserve estimates to model the impact of fossil fuel investments and holdings.

WHEW. You still with me?

Because we’re about to go deeper into the impact of being a fossil fuel company, or holding one as an asset.

FOSSIL FUELS AND IMPACT

A recently-completed database created can track the 90% of all emissions from 1880-2010, a directory of responsibility if you will. With BP, ExxonMobil and Shell responsible for 6% of all emissions there is mounting evidence, and newer legal suits, that could point to fiscal responsibility for the effects of climate change being levied on the responsible parties. 6% of the cleanup and rebuild costs from Hurricanes Harvey and Irma will not be a small amount of money – if that eats into profits every year, well.. You see where there’s a possible shareholder, economic argument for divesting from companies that

According to a recent whitepaper on this compiled dataset, which tracks fossil fuel emissions back to the providers of the fuel:

“July 10, 2017: Historic new research from CDP, voted no. 1 climate change research provider by institutional investors, in collaboration with the Climate Accountability Institute, today reveals that 71% of all global GHG1 emissions since 1988 can be traced to just 100 fossil fuel producers.”

It’s notable that 32 of these emitters are publicly-traded corporations, as this is a crucial leverage point. Are these companies in your portfolio? The research is beginning to show that they’re no longer strong contenders for making money in the long term.

And, institutional investors want to know about the exposure to climate-related risk — 100 investors managing over $16 Trillion in assets signed a 2016 statement asking for ESG disclosures (the “E” stands for Environmental). In seeking to understand this impact, it signifies that large firms are taking seriously the possible outcomes, for example flooding that could quite literally erode the tax base who undergird the repayment of municipal bonds.

DIVESTMENT STRATEGY: fiduciary responsibility

So, if we know that companies and large funds have fossil fuels in their portfolios, and that these FF holdings may lose value, how do activists get the companies or funds to divest from the FF holdings? The answer is in a regulatory practice known as fiduciary responsibility.

If you don’t know what a fiduciary is, it’s a legal agreement on the part of a person or entity to put the long-term value and stability of another person ahead of their own financial interests. In financial matters, this means placing a client’s investment returns ahead of their possible earnings. A fiduciary is important because you *want* those representing your money, which generally means your financial future, to be working for your long-term interest, and not their short term gain (in sales commissions).

If you just thought to yourself, “Isn’t that what all financial workers have to do?” The answer is NO. This is a special, additional qualification. 🙁

Fiduciaries didn’t start as a response to the 2008 crisis, the role has been around since 1974, from the Employee Retirement Income Security Act (ERISA) of 1974. But after the 2008 financial crash in the US, the Department of Labor put up new regulations requiring all investment advisors to become fiduciaries. These regulations have gone into place (although the House of Representatives has passed legislation trying to roll them back) and, they are law right now. Since they were law, most financial advisories have already registered and set up their processes as fiduciaries, and are unlikely to roll back.

This works in favor of divesting from fossil fuels because the financial advisors on Boards who oversee large funds have to comply with their fiduciary responsibility. If they have been informed that an asset type is high-risk, and they stay invested in it, they could be legally liable for losses.

For divesting, strategists review investment portfolios for large public institutions – like the NYC Pension Fund, for example – and provide risk analysis to those with fiduciary responsibility which demonstrates that these investments and pensions are less stable over the long term with fossil fuels in them. This is where divestment gets interesting, because it’s using the rules – and WORKING.

WHO’S ON BOARD?

Given the risks, some places and countries are already moving forward with divestment and related recommendations, and don’t need to find a deeply buried regulatory loophole to decide to do what’s best for the global ecosystem and their financial longevity. Unsurprisingly, European countries lead the way in fossil fuel divesting. For example, in early November, Norway’s $1 trillion sovereign wealth fund proposed dumping about $35 billion in oil and gas stocks, including Royal Dutch Shell Plc and Exxon Mobil Corp.

New York State and NYC

SUNY, New York State’s college system is joining in. As of Sept 2017, “The SUNY New Paltz Foundation board has voted overwhelmingly to remove endowment funds from direct investment in fossil fuel companies.”

NYC Activists have been pushing hard to get NYC pension funds to be fully fossil free. These funds currently have been divested from coal and prisons, which is great! But the goal for activists is to get them out of oil, too. You can read more about that here, which describes “Pension Funds [as] the Capital of US Workers” (LOVE the concept), and points out that since “Approximately $40 trillion was invested by pension funds in financial markets in 2015” there is a lot of buying – and divesting – power available to pensions.”

Additionally, several studies are in process which would unpack the long-term costs associated with carbon-related investments, including an ongoing one by the NYC comptrollers’ office.

NYC’s electoral engagement on the issue is growing: Public Advocace Letita James held a 11/29/17 public hearing in NYC officials heard from 50 speakers on the topic. At the rally outside, Tom Sanzillo, Director of Finance, Institute for Energy Economics and Financial Analysis, Former NY first deputy state comptroller said, “Investments in fossil fuels made a lot of money for New York City’s pension fund. This is no longer the case. The City and its pension funds have no choice but to act to protect themselves. Investments in fossil fuels today come wrapped in red flag warnings. The way forward is fossil free.”

For context research by 350.org reports, that out of the $191 billion in NYC’s institutional investments, “New York City’s five pension funds have invested over $27 million in TransCanada, the energy corporation building the KeystoneXL pipeline. Just two weeks ago, over 210,000 tons of oil leaked from the KeystoneXL pipeline, causing irreparable damage. In addition, more than $3 billion is invested in other fossil fuel and pipeline companies. The New York City Employee Retirement System (NYCERS) has $39 million in investments in the Kinder Morgan Pipeline and $87 million in the Dakota Access Pipeline.”

What about the ethical arguments?

For some people, the ethics of the issue are a core motivator: disasters covering ecosystems with petroleum from spills, raising the global temperature, and the inequitable impact of climate change are enough to spur action.

Leaders at Standing Rock led the fight last year to stop the Dakota Access Pipeline project and continue to fight to protect the water source on their reservation that is endangered by oil flowing through the pipeline. The effort became a flashpoint last year that brought together indigenous leaders and activists across the nation. Waniya Locke, Ahtna Dene, Dakota, Lakota and Anishinaabe tribes and a water protector from the Standing Rock Sioux Reservation, noted, “Water never resists, it flows. We can flow like water into morally decisions of our environment; boosting communities, creating social justice and preserving for future generations as we divest. We can be flowing into divestment as we Stand Up to care for one another. MNI WICONI-Water is life.”

Individuals, including the individuals in charge of pension funds and mutual funds, can be and are moved by the social impact of continued reliance on oil profits in the face of mounting evidence of harm.

Ok, I’m ready – I want to know how invested in fossil fuels my current funds are:

Then type their names into the Fossil Free Funds database and get a result. When I entered my Schwab S&P 500 Index fund (SWPPX), here’s what I got. 4.29% of the holdings are in fossil fuels, since 1.58% of their fund is in Exxon. That’s awkward. Perhaps I should dump it into my Betterment SRI account, which is getting better returns and is more diversified anyway. 🙂

If you don’t want to be totally laid bare, you can just compare what TYPES of portfolios tend to be more carbon heavy, using Macroclimate’s tool, which tells me that the S&P 500 is about 8.7% carbon, if we also count oil, gas and … coal. Yes, that stuff is still around and firing up plants, plants that make money:

What if you just want to go find a Fossil-fuel-free fund to add to your existing investment portfolio?

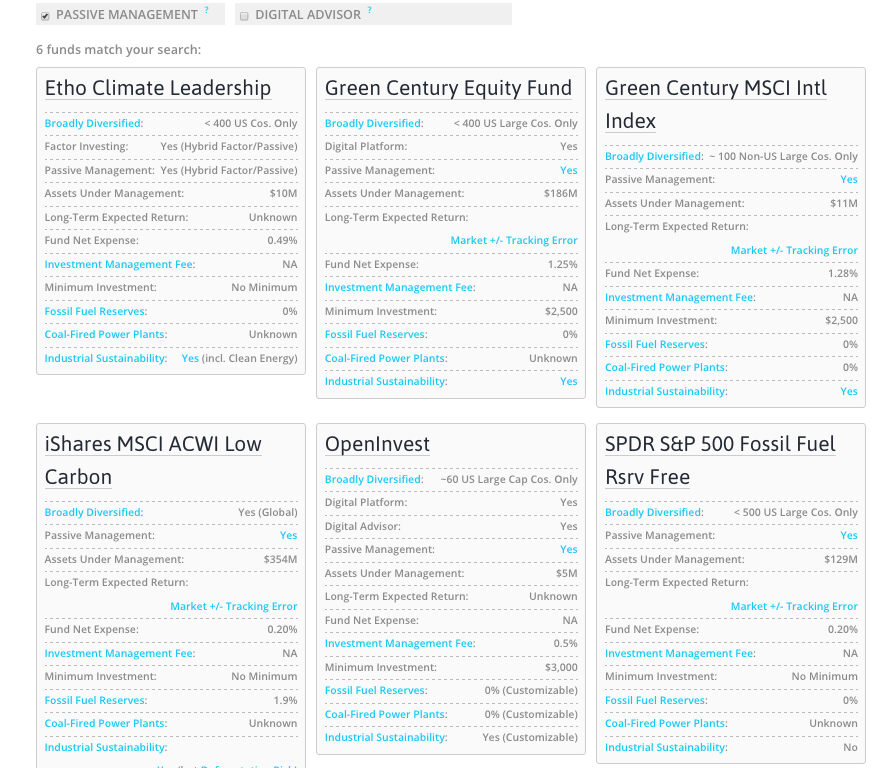

Use the Divest / Invest Guide to figure out which fund fits your needs, they track the diversification, expense/fees, FF reserves, coal and sustainability indexes on 20, and let you sort.

Because I always want more affordable funds, so the expenses eat less into my returns, I picked passive management and got these six. Four have a decent expense and of those iShares and SPDR both have:

More about the SPDR® S&P® 500 Fossil Fuel Reserves Free ETF (SPYX)

Seeks to allow climate change-conscious investors to align the core of their investment strategy with their values by eliminating companies that own fossil fuel reserves from the S&P 500.

Conclusion

While individuals can have individual-sized impact, our aggregate savings in the form of large funds can have oversized impact on moving the needle towards divesting out of fossil fuel – and ultimately keep both our investments and our planet safer.

Each day through Sunday Dec 3, I’ll share a live video or interview on fb and my blog for you to learn ways to use your money that are smart, strategic, and matter.

You can get started with a free course on bank divesting, and I’m encouraging folks to take at least three actions over the challenges’ 10 days. Share your progress on social media using #HackingCapitalism to win!