Why can it be totally overwhelming to the point of zoning out to think through the steps to your goals?

They’re supposed to be about your DREAMS, people! The things you WANT! Yet study after study shows that staying on a goal is hard.

Ever wonder why making financial goals stick is tough?

Why spending yr hard-earned money now can feel easier than socking it away for later – even when you believe that saving would be positive?

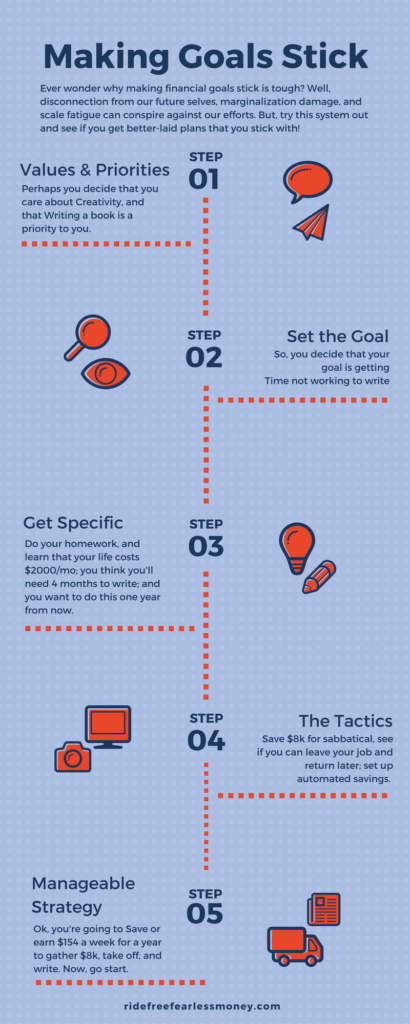

Well, disconnection from our future selves, marginalization damage, and scale fatigue can conspire against our efforts. But, there are also tested methods to work around it, and below is a specific and clear method you can use. Put the step-by-step infographic on your motivation wall, try this system out and see if you get better-laid plans that you can stick with!

Doing this, I saved up for a motorcycle by saving $20/week for 3 years, because I wanted to do something joyous that only men in my family did…until now.

Why is goal-setting for the future so hard?

1. Research shows: we’re disconnected from our future selves

In Kristin Wong’s smart treatise on goals, she quotes: “Studies show we have a really hard time connecting our present and future selves. In a study called Increasing Saving Behavior Through Age-Progressed Renderings of the Future Self, researchers tested the savings habits of participants. They showed some of them an altered image of themselves at 70-years-old. Researchers found that those participants who viewed a photo of their “future self” saved twice as much money in a retirement account than the control group, who were simply shown a photo of their present selves. Here’s what the researchers reported: ‘To people estranged from their future selves, saving is like a choice between spending money today or giving it to a stranger years from now. Presumably, the degree to which people feel connected with their future selves should make them realize that they are the future recipients and thus should affect their willingness to save.'” (cite)

So, for some of us, we’re not thinking of saving as paying ourselves first, we’re literally thinking of a stranger. That would make it tough, but I don’t think that’s all.

2. Marginalization damage to our future selves

Additionally, it may not be clear to people who’ve experienced systematic oppression that there IS a future for them to plan for. I’m looking at anyone who has assumed their longevity is shortened for reasons out of their hands (police violence, location volatility, environmental illness, lack of access to food/medical care for a stretch of life).

For folks in this category (including me), it’s not just disconnection — we’re actively shown there’s no future to plan for. We see people like us, around us, not survive. And yet, here some of us still are, old enough to read blog posts and wonder about the future after all — so, the reasonable fear factor of what might happen disrupts the evidence of the present in which the future is barreling forth one day at a time.

3. Scale fatigue

Finally, I bring up scale fatigue, the unfathomable precipice of a daunting task … what also could be called Omnipotence Paradox – when “a being creates a task it is unable to perform”.

This is a framing error you create for yourself when you focus on the whole problem and its final solution as a totalizing end point. For example, “my student debt is $80,000, and I have $179 in the bank, not $80k – therefore I will never achieve payoff.”

You just thought of something in a scale SO BIG it became impossible to deal with. No wonder take-out feels easier, geesh. You are trying to hold the big picture and the daily reality together at the same time. That makes it really hard to jump from here (debt) to there (paid off).

So, what’s a solution?

It’s true that connecting to your future self can be hard, but she/ze/he is your best friend in getting to a future goal. Why? Because when you care about the goal, it gets easier to commit to the action.

Here’s your little trick: make the action towards your goal small enough to be doable — and set yourself up to do that little action.

Giving that future person the benefit of you “paying yourself first” in the present is best done manageably, in connection with things you care about now, with a bridge plan from now to future.

I have a short process I want you to try to get to your next goal:

- Define the goal with value/motivation unpacked –> why does it matter? what’s your motivation, connection, legacy, value, etc?

- Determine tactic strategy w/a specific $ amount and timeline –> get specific as HELL here. How long this will take, how much money, with what tools…

- Make steps actionable and small enough to be manage, and commit to the step in service of the goal.

BONUS STEP: write down your goal-getting plan!

A Harvard study showed that writing your goal helps it stick (among other factors).

Here’s an image with an example, and I’ll spell it out.

For example: Say that creativity is important to me, and I want to write a book. I check my bank statements to realize that I need $2k a month to live on, and I assume that I can write my book in four months (haha?), so I surmise that I need to save $8k to take 4 months off and write a book. Oops I have $0 in the bank — how do I jump to $8,000?

Don’t go to $8,000 first — make it smaller.

$8,000/52 weeks in a year= $154 a week.

$8,000/365 days in a year = $21.92 a day.

Breaking it down, you learn that you could choose to save or earn an extra: $21.92/day for a year or $154 a week. There’s your $8,000.

Suddenly, all those 000s are reduced to less than $22 bucks, and that is going to something specific, so saving it feels less painful — it’s for you after all, something you’d freaking love.

Finding the money might be hard, but a defined number always means you can save or earn more easily, too.

Two things are in your favor here:

1. Manageable Strategy

2. Motivated by something you care about

And the outcome is still going to be giving future you something, out there, in the future. Who knows, by the time you get a little closer, perhaps future you will be a little easier to believe in. And won’t you be glad you started already?

Folks who’ve taken my classes, have these awesome goal outcomes on average:

Folks who’ve taken my classes, have these awesome goal outcomes on average:

- 100% of participants report taking two or more positive actions, changing their finances for the better

- 70% of participants take 5 or more positive actions less than one month after starting!

- 80% create and start using a budget they can stick with.

- Check out the course here, it’s more affordable than you might think — and it’s WAY more affordable than never taking positive action around your money goals.