Friends, the year is moving along – so, how’s your money stuff? it’s been an unusual year with what some people are calling two economies: one, where hiring and the stock market is up and, another where jobs are lackluster and wages are stagnating and the cost of everything is making money tight. Which economy are you experiencing?

THINGS TO CHECK ON HALFWAY THRU THE YEAR

- Personal finance reality: income, spending, save/invest, giving/impact

- Self-employment /small business: revenue, clients/customers, product/services, down time

- Enough-ness metrics: what needs, goals, and gaps is your money letting you address?

PERSONAL FINANCE AREAS TO CHECK ON

- Income – Are you earning enough? Do you like what you’re doing to get money?

- Spending – Are the basics covered? Are you in control and intentional with extras?

- Giving & Impact – Are you sharing money, resources, or time in ways that feel aligned to values?

- Investing – Is money kept for problems, goals, annual expenses, and the future – and where?

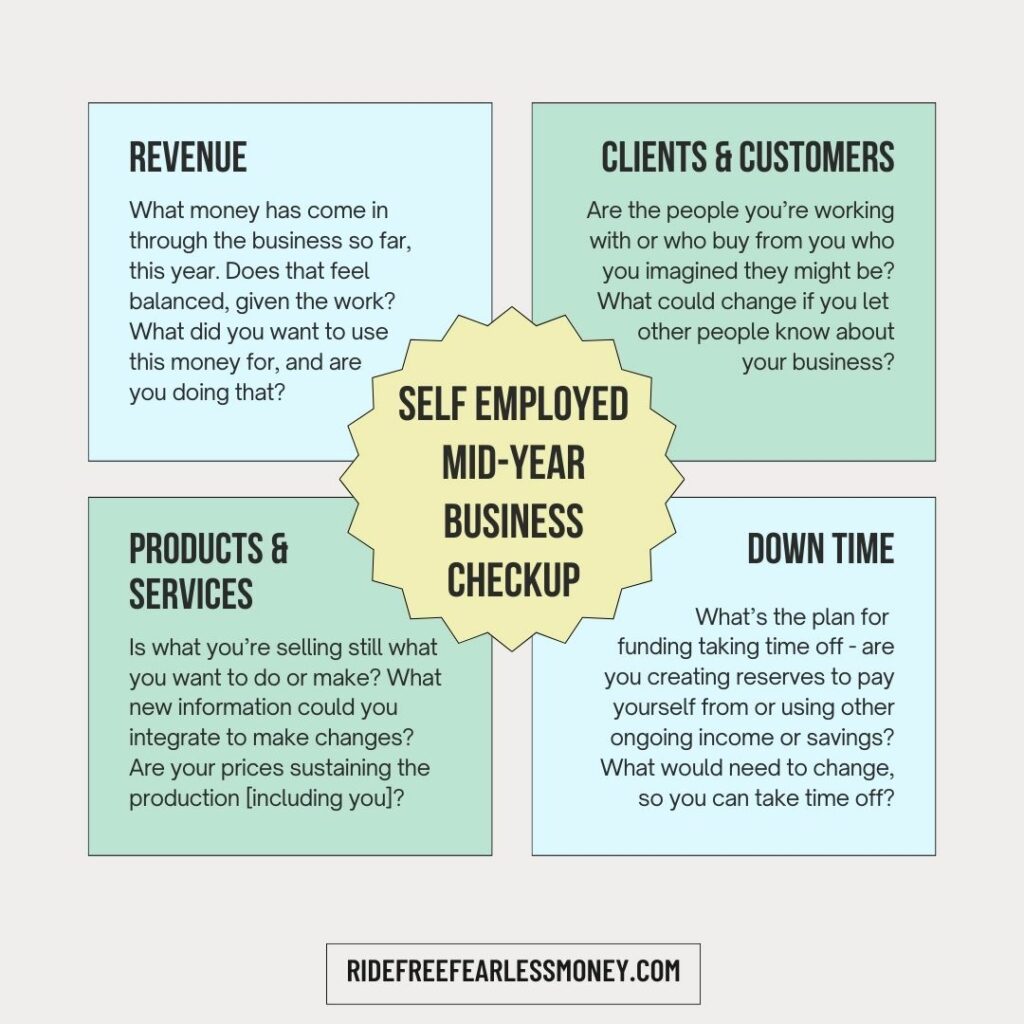

BUSINESS MID YEAR CHECK-IN

Revenue

What money has come in through the business so far, this year. Does that feel balanced, given the work? What did you want to use this money for, and are you doing that?

Clients/Customers

Are the people you’re working with or who buy from you who you imagined they might be? What could change if you let other people know about your business?

Product/Services

Is what you’re selling still what you want to do or make? What new information could you integrate to make changes? Are your prices sustaining the production [including you]?

Down Time

What’s the plan for funding taking time off – are you creating reserves to pay yourself from or using other ongoing income or savings? What would need to change, so you can take time off?

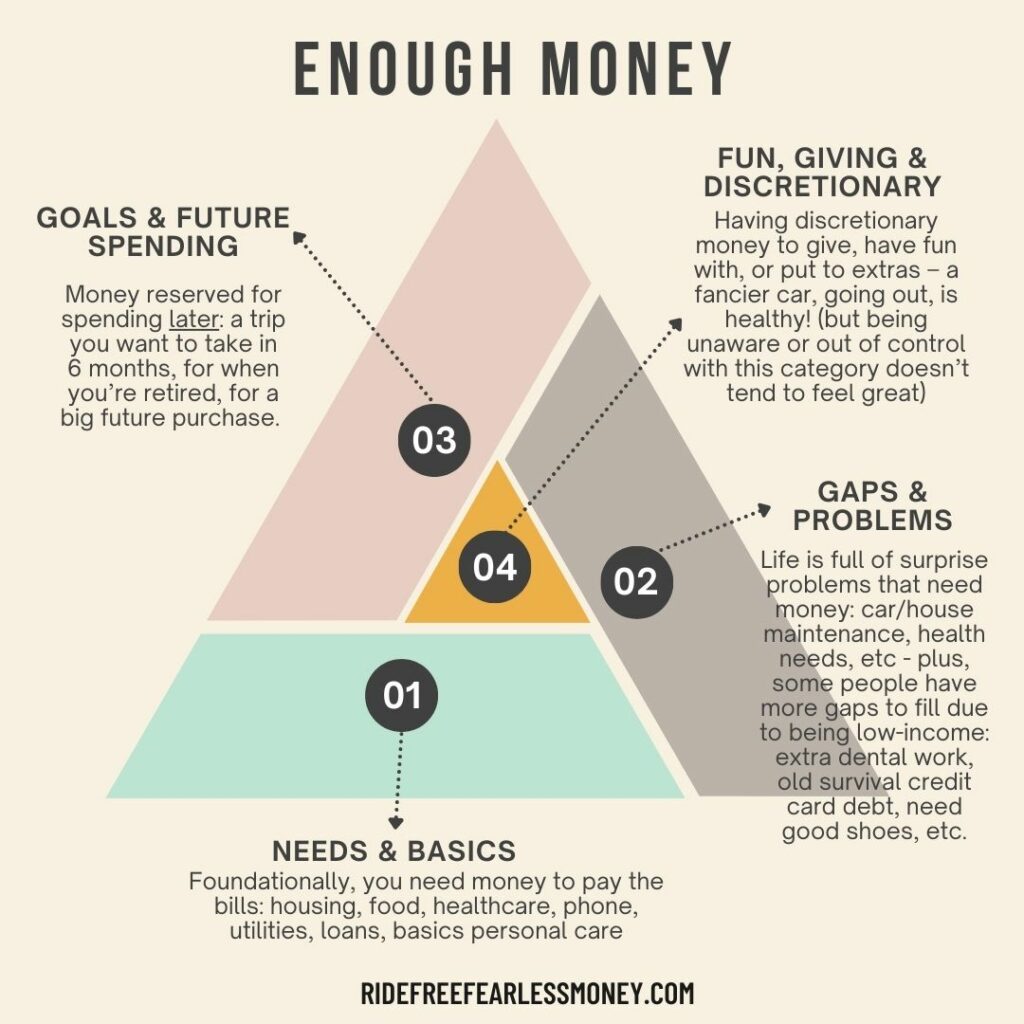

Do you have “enough” money

The ways which you can tell if you have “enough” money can be slippery, especially when you:

A / live in a society that worships conspicuous consumption and billionaires, and

B / are trying to fill in gaps from not having had enough money at some point[s] in life

I think of “Enough” as being able to cover: needs, gaps/problems, goals/future, and have some fun/discretionary/giving money available.

Foundationally, you need money to pay the bills: housing, food, healthcare, phone, utilities, loans, basics personal care

Life is full of surprise problems that need money: car/house maintenance, health needs, etc – plus, some people have more gaps to fill due to being low-income: extra dental work, old survival credit card debt, need good shoes, etc.

Money reserved for spending later: a trip you want to take in 6 months, for when you’re retired, for a big future purchase.

Having discretionary money to give, have fun with, or put to extras – a fancier car, going out, is healthy! (but being unaware or out of control with this category doesn’t tend to feel great)