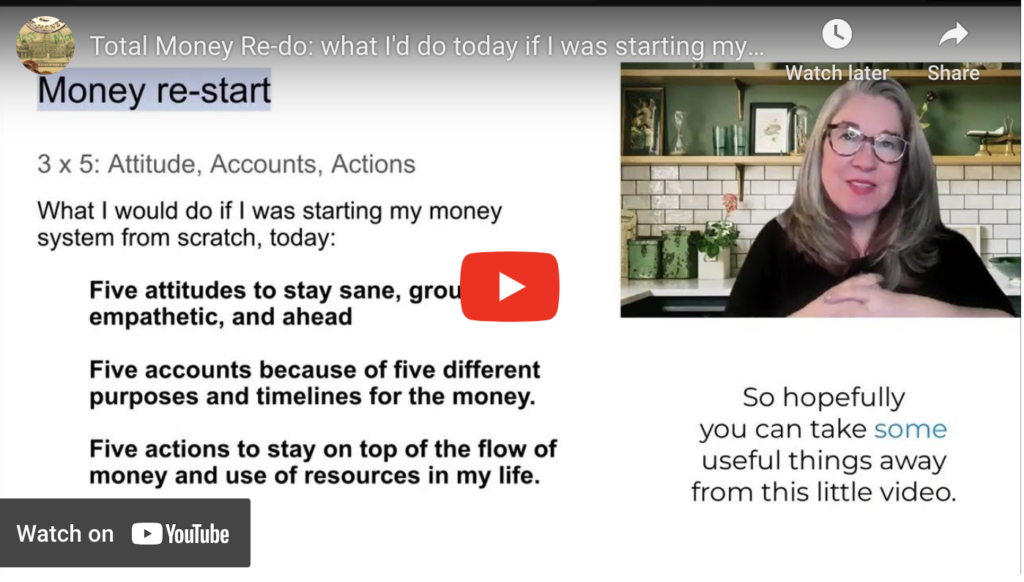

What I would do if I was starting my money system from scratch, today:

Five attitudes to stay sane, grounded, empathetic, and ahead

Five accounts because of five different purposes and timelines for the money.

Five actions to stay on top of the flow of money and use of resources in my life.

ATTITUDE

- It’s not right out there, but financially caring for myself is still ok to do

- A well-paying role which I like and want to do exists and is the sweet spot of jobs

- Paid jobs are only part of what make life good – when am I having fun and how can I have more of it

- Ideally I can make money without time: stock options, RSUs, IP patents, royalties…

- The fact that I am even asking any of this means that I am doing better than others, so how can I give back, and bake giving back in to my time and spending?

ACCOUNTS

- Have a checking account at a credit union or coop bank to deposit my after-tax income and pay my monthly bills. Also have a credit card here.

- Have a high yield savings account [HYSA] for my emergency fund + if I had fully funded this, I’d put ½ of it in a iBond or CD as long as the rate was higher than my HYSA

- Have a different high yield savings account for my sinking funds [car insurance, travel, tattoos, new stuff upgrades] – either one account for each purpose, or one account that used a bucketing

- Have a ROTH IRA if I was earning under $100k + contribute to meet a match in any employer-sponsored retirement account

- Have a roboadvisor investment account, invested in a “Impact” portfolio focused on new energy (solar and batteries etc), for money I want to have available but don’t think I’ll need for 5+ years.

ACTIONS

- Move money to savings/investing automatically, scheduled for a day after my paychecks hit my checking account.

- Pay all bills and credit card on autopay, pay off credit card every month

- Every three months, look back and look ahead at what money I earned, what I expect to come in, and what expenses I have coming up. A trip? Holidays? Decide if I’m saving enough to pay for the things I want and adjust my spend if needed.

- Once a year, net position: sum up everything I owe and have in various accounts; log in to everything and see what’s happening. Ask questions about the direction of my finances like: am I paying down debt? Is my retirement balance going up? Have I saved up enough for that big trip with my kids/sabbatical/car deposit and if not when do I think I might?

- If things feel wrong at any point, ask myself what I might try, to change them – and be imaginative. Temporarily spend less? Look for a new role or change to a different industry?

Try any of these on your own – you could TOTALLY self-guide this work. And, if you want some support, consider joining Money Like You Mean To, a workshop I run every few months. It’s sliding scale, has 2 live, remote, learning/reflection sessions and 3 open space coaching sessions. You got this!