For Ride Free’s Five year anniversary this month (!) I’m taking you inside my financial journey over the last five years. In this second post, what I learned from you, my clients, workshop attendees, and readers – that radically changed how I feel and act about money.

Instant life change is cinema fiction: big results are the accumulation of lots of little shifts and actions alongside a few leaps of faith. Whether it’s socio-political change or personal change — one vote, or one money moment — we must do the little things, BECAUSE they add up to the BIG change, over time.

And then one day, WHAM! You realized, change has arrived.

It took me three years to really *feel* the outcomes of changing my relationship to money. When I started to examine what helped me, I quickly turned to you all: readers and co-conspirators here to do money different with me.

What I learned:

- No one picks how they’re born

- No one feels like they understand money and most people want to feel more secure

- There’s more money than you think

- Money is more a feelings problem than a math problem

- Spending money accidentally is a symptom, and so is never spending

- NO ONE PICKS HOW THEY’RE BORN

How many productive things come from shame? Zero, babes.

Before I understood how people got money and how much they had, all I had was my experience of how shitty it was to be without enough money — and I felt resentful and ashamed. From not going on school trips as a kid, through the years we were food insecure, to the first plane ride at 19 that I paid for myself instead of heating my apartment that winter, to the challenge of figuring out adulthood without any adults to follow, for so long I held my experience as somehow uniquely bad and my struggles as my personal cross to bear.

Talking with many people about money taught me fast that none of us picked our early life money experiences. I noticed that feeling conflicted and hard about money is really common. I got to step out of my self-focus and develop empathy for people who “had it easy” – because, they didn’t, from their perspective. Scarcity and fear are perceptions, not bank account number triggers. Power and control show up in all kinds of weird family dynamics, which seem to increase with the volume of money at play, and there appears to be no cap on the ways the handling of money when we have limited power, like as kids, can cause us to suffer.

I believe this is a root cause as to why so many folks instinctively distrust and dislike money itself: it’s connected to early pains and deep senses of fair / not fair. Of course, it’s not precisely money doing this, it’s the impacts of socioeconomic inequality or hoarding behaviour in a society that rewards greed, requires money to get things, and equates money with power and decisions.

What you can do with this: Swap stories with someone who you know has a different experience than you. Listen for pain and don’t compare it to your own. Look for pride and don’t use it to judge.

- NO ONE FEELS LIKE THEY UNDERSTAND MONEY AND MOST PEOPLE WANT TO FEEL MORE SECURE

Listening to a few thousand people express their questions and insecurities about money, I realized that having questions and a need for security is about money wasn’t an individual failure on my part – or others art. It’s normal to want to feel like we have some control and some security.

Being willing to teach what I knew about finances, which happened to be a bit more than most folks, meant I could also go ahead and learn more about money, too. As a behavioral approach, it helped me go from focusing on what freaked me out about money to what I was confident about, which meant I could go get good at the next thing more easily.

What you can do with this: We all might have different questions, related to what’s important to us in life at the moment, or what our situations are. And that’s cool – the next step is to realize it’s okay to get those questions answered and take actions as you do. This will help you develop new questions. That’s not a failing – that’s moving to different levels of understanding, priorities, situations, or stages of life. These are basic human journeys for all of us, and it’s ok to be on the journey.

- THERE’S MORE MONEY THAN YOU THINK

However much you think “a lot” of money is….someone has more than that and they probably don’t think as much of it as you do. My clients who made $80k/year blew my mind when I started this work, since I was making $40k/year and that was familiar. I really had to work to understand that making more money than I felt familiar with wasn’t a freak edge case, it was simply a part of everyday reality.

First, I had to stop hanging out in shame and then I could start hearing money stories with curiosity. Over and over, my “holy crap” was someone else’s “normal year” — and it completely rebuilt how I think about money: from “some wild and uncatchable animal that hates me” to a practical, relatable resource that comes in different sizes. I learned to stop thinking “this is hard” and shift to “this is possible” due to the evidence. Now, my clients who make $275k+/year consulting inspire me with what’s possible financially.

What you can do with this: if you don’t like how much money you make, look at salaries that people have shared, or talk to people who make more money. What are these jobs? What’s their life about? What was their path?

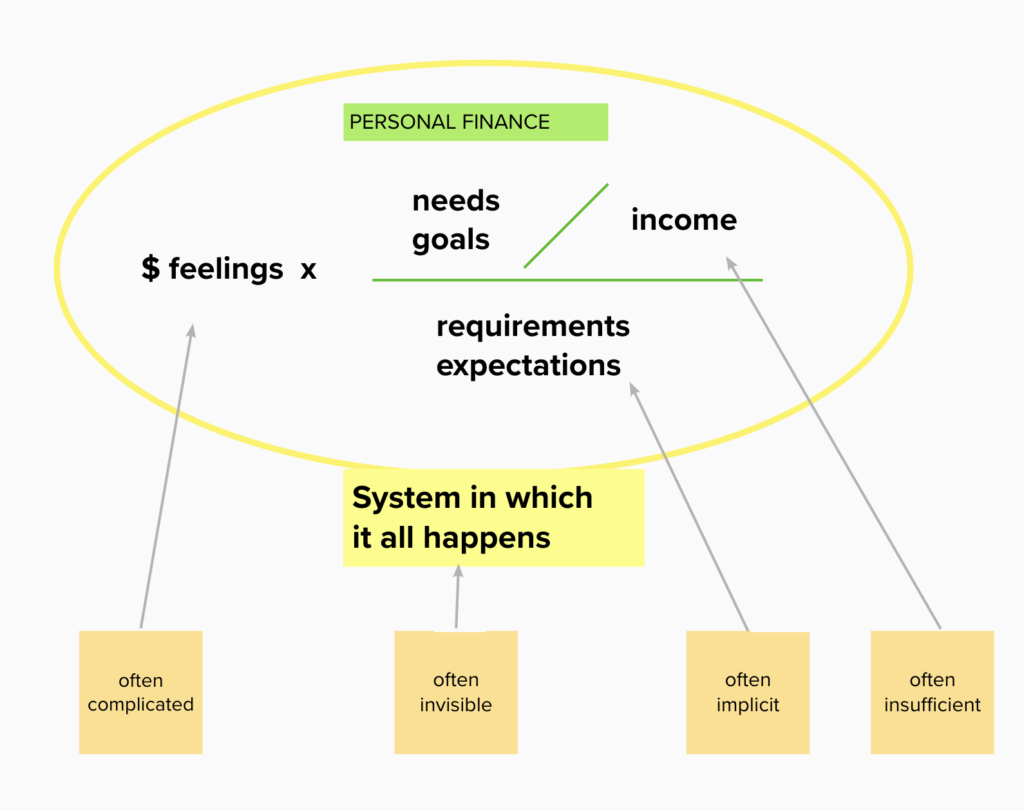

- MONEY IS MORE A FEELINGS PROBLEM THAN IT IS A MATH PROBLEM

Money feels unnecessarily complicated because of feelings, not math: Overwhelm, avoidance, judgement, fear, shame, confusion, rejection, etc about things related to money are often in the way of being chill enough to reason through practical work. So, let’s get into feelings.

When I first started money work I dragged people through detailed budgets, assuming fresh numbers were the solution.

This is only marginally true: yes, you do need to know what you’re spending and to determine you’d like to do with your money, but there’s a lot of ways to get there. No, quickly I observed that most people have a felt sense of untouchableness to some aspect of their finances – something that is steeped in judgement or clouded by a belief there’s a secret language given to others, not them. THAT is where I learned the work needs to dive deep into: and where I had to dive in, for myself.

I needed to deal with my shame about earning and fear about not having money in order to heal. To do that I did two things to reframe and rebuild so I could get proud and fearless: honestly, reviewing my retirement accounts and automating more money into them, and making movement on down payment savings gave me evidence that helped me let go. Ah, when being practical actually IS what you need. Taking the action was the key that helped me go back to my gnarly feelings and starty to heal.

What you can do with this: Automate some math so you can focus on dealing with the feelings. Forget Mint, it confuses most everyone – just literally read your most recent bank/credit card statements and add up what you spent, by categories, for the real tea. This is part of the next practical step: decide change how you use money ONLY as related to two things most important to you: destroy debt? Fund a goal? Give money to the movement? When you just pick a few focus areas and automate them based on the cash flow you have, you free your worry-brain to work through the more important stuff like healing.

- SPENDING MONEY ACCIDENTALLY IS A SYMPTOM – SO IS NEVER SPENDING

Symptoms tell us there’s a bigger issue to examine. Perhaps it’s: Intentionality? Accepting reality? Choosing your priorities? Living in fear?

Shocking no one, our society is set up to make it easy to spend money! But as the last 7 months have shown us, there’s lots of spendy things we can live without. Spending as an activity unto itself is only available in a very broken world, where real experiences and connections seem financially mediated. If you’re buying consumer stuff, even if it makes you feel broke, you have extra money – going places it would behoove you to understand.

I’ve noticed a pattern: someone has a category or two of spending that operate like a black box: it’s the unknown, and it’s where all the “extra” money goes. There’s a goal in mind that’s not being hit and the money needs to be re-routed. Yes: examine the numbers and set up auto transfers. But also, examine why it’s happening and what you want instead.

It’s ok to want stuff — but stuff doesn’t satisfy, purpose does. Your goals are much more exciting than stuff – they will motivate you at a level that a new sweater never will. Seeing so many people have to re-think spending made me realize that I needed to as well.

Y’all, low income folks don’t as often have issues with accidental spending *because there’s not any money to be accidentalling* as budgeting is more real time, and therefore on purpose. And low income folks have plenty of real experiences and connections without the spendaroo. Shifting out of a state of highly restricted spending is also hard and takes practice and intention. I had to learn that I could spend money a bit more freely as I began to earn more. I still wanted to be spending on purpose, but had to build the muscle of accepting that reality had changed and so could my spending.

I saw clients feel more control and when exchanging their money took some thought, just as I had to teach myself not to obsess too much about it. The middle ground of “safe to spend” funds and a plan for where money’s going gets at the root of overspending or underspending.

What you can do with this: If you get a raise/new income/extra gig money, immediately generate ideas for where that money’s gonna go – don’t let it loiter in your bank account acting like it’s available. I’m talking: automate transfers to savings or to whatever goals you have and leave yourself some to enjoy, too. Your checking account is not Tinder and swiping out the money mindlessly won’t refill.

Reflecting on these big things is part of why I decided to revise how I coach and work with people! You told me what you need, and I have a new way to give it to you — Money Like You Mean To monthly group cohorts!