What’s Socially Responsible Investing (SRI)?

In short, it’s investing in companies that are actively or adjacently doing some form of social or ecological good.

People choose SRI because:

It diversifies and strengthens a portfolio: Research is showing an unsustainable carbon bubble (in the form of oil reserves and profits) holding up a lot of corporate profit margin, and when carbon fuel runs out and that bursts we may see a fall in markets that lean on it.

Additionally, it speaks to values. There’s a lot of interest in supporting progressive corporate behavior by putting your money where your mouth is and funding outcomes you support or orgs you believe may move to even more positive places. Corporations are even beginning to file environmental, social and governance (ESG) reports along with profit reports so one can find out more about a company’s nontangible impacts.

How I interact with SRI

I currently have about 15% of my investments in two SRI funds. One is an impact strategy where I invest in oil-free energy alternatives, and one is an advocacy strategy where I invest with companies who’ve demonstrated they’re open to treating their employees better and the fund pushes them to do even more. Even though I care a lot about the environment, ending systemic racism, and labor equity I don’t have all my money in SRI, and here’s a bit about why.

When is Responsible Investing Not Responsible?

In part because math: you want to diversify in general, you want to pay lower fees and SRI mutual funds tend to have slightly higher fees. And, at least now while carbon energy is a-flowing, there’s generally a slightly smaller return on a lot of these funds’ asset classes than others.

In part because strategy: some SRI critics argue that investing where you’ll get the most money and then using your profits to invest in nonprofits is more effective than SRI investing in the first place. Looked at this way, “regular and dirty” investments might be a strategic way for you to siphon money from nasty organizations to fund goals that matter to you. Frankly, those of you with large trusts or inheritances probably got your money from those, which many of you are using for social good.

In part because greenwashing: the conversation about socially responsible investing is often at best sanitized and at worst turns desire for social change into a vague “responsibility” data point on a corporate report card.

Where SRI (and all of our economic system, to be fair) is unaccountable is to specific, necessary, radical change.

I want conversation to specifically include the deeply racialized inequalities around accumulation of resources in the US and specific strategies to address that and lead to more black and brown people with resources, perhaps by divesting to end corporate practices that de-resource, redline, and environmentally harm black and brown neighborhoods. I want SRI to specifically state that poverty is a problem that shareholders can address by advocating for higher wages from companies they own stock in.

Finally, I’m struck over and over again by how freaking white and wealth-classed the people producing knowledge on the topic of responsible investing are (not that my whiteness changes that metric to be sure) and in the context of the sanitization, it’s troubling not to have specifics. The crack in the system needs to come from all sides. Middle class and resourced people have a plethora of opportunities to nudge things. I can understand why – given the sanitized context these things are presented in – one light not but damn if it’s not a missed opportunity.

So why do you want me to know about SRI at all then?

With this knowledge, many of you (and me!) still want to put at least some of our money somewhere we can believe it is positively nudging the companies we’re funding, removing money from things we can’t stomach, or funding the damn future. With this motivation, here’s two ways I want you to strategize with money you do choose put into SRI.

Two strategies to select funds or stocks based on their holdings or impacts:

Using a positive “Divert” framing:

- Impact Investing — I’m giving my money to companies or funds that I already think will do good with it

- Advocacy Investing — I’m giving my money to funds that will leverage it to pressure companies to improve or change policies for social or environmental betterment

Using a negative “Divest” framing:

- I will not give my money to companies that use it for XYZ (often oil, weapons, tobacco, prisons…)

- I will not give my money to companies that rely on or profit from XYZ (often oil, oil reserves, war, etc)

And h ere’s where to look for these funds:

ere’s where to look for these funds:

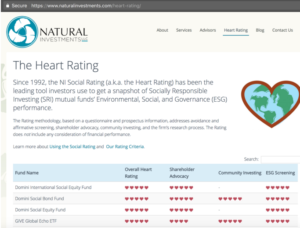

Check out the Heart Rating, that lists SRI funds by impact and then go ahead and research each fund you’re interested in to see:

- what’s in the fund

- what returns you can expect over a 10year horizon

- what the annual fees are

- and think about where in your investments the assets in them will help you diversify what you have.

Look: I want you to have resources.

Once you’re ready to save in a bigger way, any investment strategy you pick should take into account your overall needs: retiring, saving for a big purchase, generating funds for sharing, etc.

It should also take into account your interests and priorities. That might mean you’re not excited to make money from organizations that poison water or people, for example.

Finally, it should take into account your whole-life situation. If you’re the first person in your family to have enough resources to save, I want you to maximize and make money on those resources. If you have a large inheritance, you have a different opportunity situation to effect change with investments themselves.